![UltraTech Cement price chart — December 11, 2025]

Price: ₹11,455.00 Change: +138.00 (1.22%) Date: December 11 2025, 03:31 PM

Technical Overview

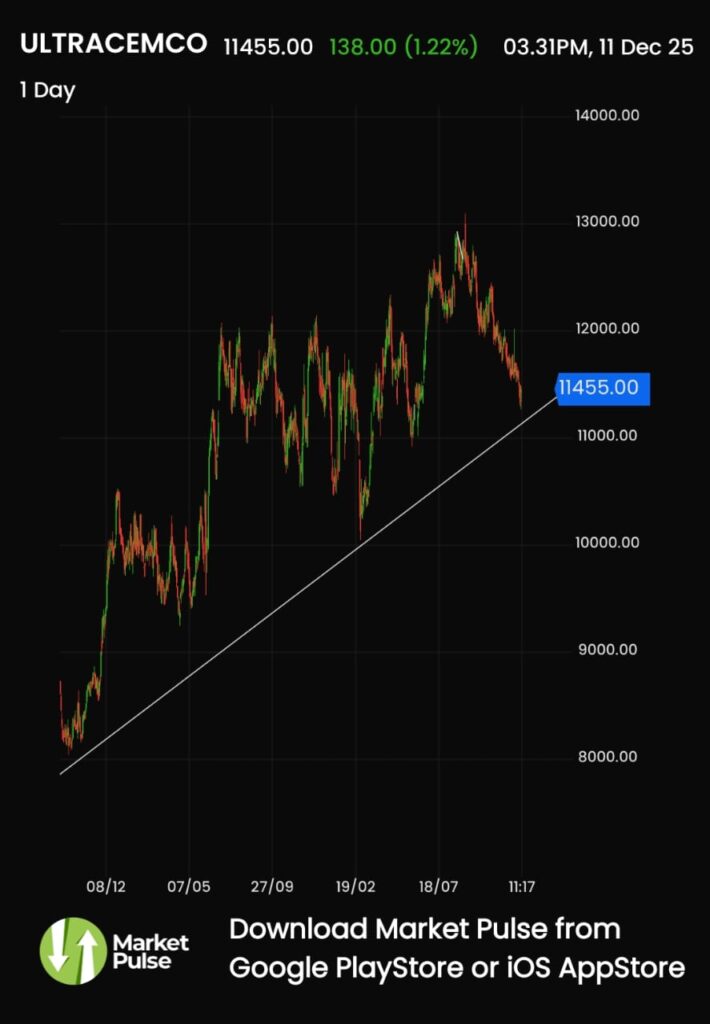

UltraTech Cement — India’s largest cement producer — is currently hovering near a long-term ascending trendline that has supported price momentum for over a year. As seen in the chart, every major pullback since late 2023 has found footing along this rising line, triggering subsequent recoveries.

Currently, ULTRACEMCO is trading around ₹11,455, having corrected from its earlier high near ₹13,000. The recent bounce of +1.22% suggests that buyers are returning near the trendline — a positive technical sign if confirmed with follow-through.

Key Technical Levels

- Immediate support: ₹11,200 – ₹11,400 (zone around the trendline)

- Next support: ₹10,800 – ₹11,000 (previous swing low)

- Immediate resistance: ₹12,000 – ₹12,300

- Major resistance: ₹13,000 (previous peak)

As long as the stock holds above ₹11,200, the broader uptrend remains intact. A decisive close below this level, however, could open the door for deeper consolidation toward ₹10,500 – ₹10,800.

Fundamental Backdrop

UltraTech continues to show strong operational resilience amid sectoral cost pressures:

- Capacity expansion: The company’s ongoing brownfield and greenfield projects will push capacity toward 170 MTPA, strengthening market leadership.

- Healthy demand outlook: Rural housing, infrastructure, and real-estate projects are driving consistent cement consumption across India.

- Margin improvement: Softening petcoke and fuel costs are expected to support EBITDA margins in FY26.

- Debt control: With improving cash flows, leverage ratios remain comfortable, enabling steady capex without significant balance-sheet stress.

Analysts continue to view UltraTech as a core structural play on India’s infrastructure growth story, supported by robust fundamentals and management credibility.

Market Outlook & Recommendation

From a technical standpoint, the current setup indicates a potential short-term rebound from trendline support. If price sustains above ₹11,400 and crosses ₹12,000 with volume, the stock could aim for ₹12,600–₹13,000 in the near-to-medium term.

Trading Strategy (for educational illustration):

- Entry zone: ₹11,300 – ₹11,500

- Target: ₹12,600 – ₹13,000

- Stop-loss: ₹11,000 (on daily close basis)

Investment View:

For long-term investors, UltraTech remains a fundamentally strong large-cap with leadership in capacity, cost efficiency, and growth visibility. Corrections near the long-term support zone have historically offered attractive accumulation opportunities.

StocksOrbit Takeaway

UltraTech Cement is currently testing its structural uptrend line — a zone where patient investors typically start accumulating. If global commodity prices stay steady and domestic demand remains firm, the stock could reclaim higher levels in the coming months.

However, a breakdown below the ₹11,000 zone could signal temporary weakness — watch for confirmation before committing fresh capital.

Disclaimer:

This analysis is meant solely for educational and informational purposes. It is not investment advice or a solicitation to buy or sell securities.

StocksOrbit.com and its authors are not SEBI-registered investment advisors.

Investors are advised to perform their own due diligence and consult a qualified financial advisor before making any investment decisions.